LTC Price Prediction: $350 Target in Sight as Institutional Demand Grows

#LTC

- Technical Strength: LTC trades above key MAs with bullish MACD divergence

- Fundamental Catalysts: Corporate treasury adoption and payment integration

- Price Targets: $130 (near-term), $350 (bull case)

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerge

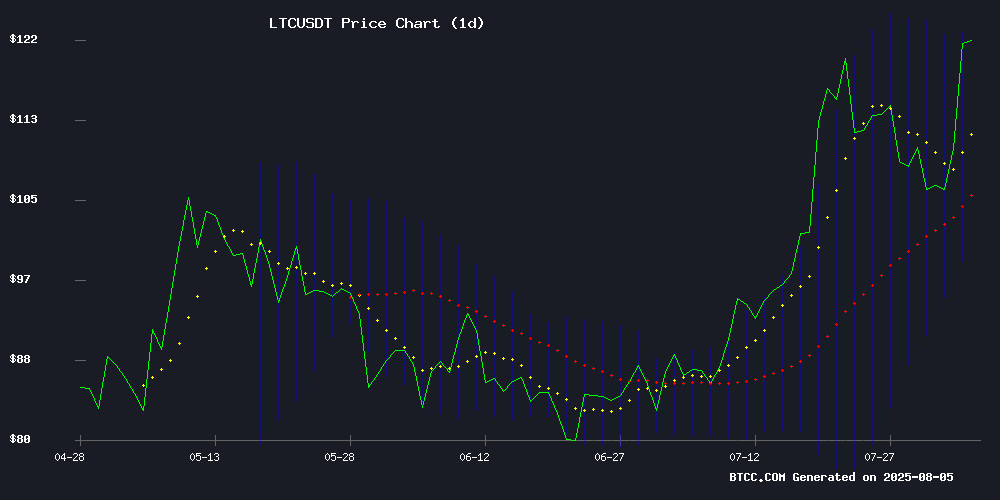

Litecoin (LTC) is currently trading at $120.26, above its 20-day moving average (MA) of $111.68, indicating a bullish trend. The MACD histogram shows positive momentum at 4.7799, while the Bollinger Bands suggest potential resistance NEAR $122.61. According to BTCC financial analyst Ava, 'LTC's technical setup supports further upside, with key support at $100.75.'

Litecoin Gains Momentum Amid Institutional Adoption

Litecoin is defying market trends with an 11% weekly surge, driven by corporate treasury allocations (e.g., MEI Pharma's $100M investment) and rising crypto payment adoption. BTCC's Ava notes, 'ETF Optimism and AI-driven capital inflows could propel LTC toward $350, though $130 remains a near-term resistance level.'

Factors Influencing LTC’s Price

Australian Online Casino Market Expands in 2025 with Crypto Integration

The Australian online casino market has surged in 2025, offering players diverse gaming options, lucrative bonuses, and secure payment methods. Crypto-friendly platforms have gained traction, with several casinos now accepting digital assets like BTC, ETH, and LTC for seamless transactions.

Leading casinos are distinguishing themselves through mobile optimization, generous welcome bonuses, and specialized offerings such as live dealer games and extensive slot libraries. The integration of cryptocurrency payments reflects broader trends in financial technology, catering to tech-savvy players seeking faster and more private transactions.

Litecoin Defies Market Pullback as Corporate Adoption Sparks Rally

Litecoin has surged 13% this week against a backdrop of broad crypto market declines, with trading volumes doubling to push prices toward $128. The outlier performance follows MEI Pharma's establishment of a $110.4 million LTC treasury—marking the first public company to adopt Litecoin as a reserve asset.

MEI's $100 million acquisition at $107.58 per token has already yielded $13 million in unrealized gains. The move mirrors corporate Bitcoin strategies pioneered by MicroStrategy, though Litecoin's lower volatility and Bitcoin-like architecture appear to be attracting institutional interest.

While Bitcoin remains the preferred treasury asset for most firms, Litecoin's recent adoption signals expanding confidence in alternative crypto stores of value. The token's blockchain fundamentals—including faster transactions and lower fees than Bitcoin—are gaining recognition among capital allocators.

Litecoin Price Prediction: A 50% Rally in Sight Amid Whale Caution

Litecoin has surged past $120, marking a 10% daily gain as broader crypto market sentiment improves. Technical analysis suggests a potential 50% upside, but on-chain metrics reveal looming headwinds.

Open interest exceeding $1 billion signals strong futures market participation, yet spot exchange inflows indicate profit-taking readiness. The $129 resistance level remains a key battleground, with CMF divergence hinting at short-term consolidation before higher targets.

Whale activity presents the critical catch—while derivatives traders build long positions, increasing exchange deposits suggest large holders may soon liquidate. This tension between futures momentum and spot market flows creates a precarious balance for LTC's next move.

MEI Pharma Allocates $100M Treasury Reserve to Litecoin in Landmark Institutional Adoption Move

Nasdaq-listed biotech firm MEI Pharma has made history as the first U.S. public company to adopt Litecoin as a primary treasury reserve asset. The $110.4 million acquisition of 929,548 LTC tokens signals a strategic shift toward operational cryptocurrency use beyond speculative trading.

The decision, developed with crypto market maker GSR and Litecoin creator Charlie Lee, reflects growing institutional confidence in blockchain's real-world utility. MEI cited Litecoin's 13-year uptime record, transactional efficiency, and merchant adoption as key factors in selecting LTC over traditional cash reserves.

This move represents a watershed moment for cryptocurrency adoption, demonstrating how non-financial corporations are beginning to integrate digital assets into core treasury management strategies. The pharmaceutical company's endorsement lends credibility to Litecoin's value proposition as a reliable settlement layer.

Litecoin Rises to Second Place in Crypto Payments, Trailing Only Bitcoin

Litecoin (LTC) has surged to become the second-most utilized cryptocurrency for payments on CoinGate's platform, according to the Lithuanian payment processor's July data. The digital asset now commands 14.5% of transactions, eclipsing stablecoins and trailing only Bitcoin's dominant 22.9% share.

This adoption milestone comes despite Litecoin's modest 19th-place market capitalization ranking. The network's faster block times and lower fees compared to Bitcoin appear to be driving merchant acceptance, particularly for smaller-value transactions where cost efficiency matters most.

CoinGate's infrastructure supports over 70 cryptocurrencies, with Tron (TRX) and dollar-pegged tokens USDC and USDT rounding out the top five payment options. The platform serves both e-commerce and brick-and-mortar businesses seeking to tap into the global crypto economy.

Litecoin Faces Resistance at $130 Amid Bullish Structure

Litecoin's recent 9.66% surge met firm rejection at the $130 resistance level, a historically significant barrier on higher time frames. The digital asset now appears range-bound between this ceiling and a robust support zone near its point of control.

Market structure remains bullish with higher highs and higher lows intact. Volume-backed support suggests potential for another breakout attempt if the current floor holds. Conversely, failure to maintain this level could lead to extended consolidation.

The coming sessions will prove decisive for LTC's near-term trajectory. Traders are watching whether the cryptocurrency can build on its recent momentum or if it requires further accumulation before challenging resistance again.

CoinDesk 20 Index Dips Slightly as AAVE Leads Decliners

The CoinDesk 20 Index edged 0.2% lower to 3,823.76, with eight of its 20 constituents managing gains. Polygon's POL token surged 6.4% while Litecoin rose 4.6%, offsetting losses from AAVE and Stellar's XLM which fell 2.1% and 1.7% respectively.

Market participants observed cautious trading across digital assets as the index extended its mild pullback from Monday's close. The benchmark continues to serve as a key reference point for institutional investors, trading globally across multiple platforms.

Litecoin Hits Five-Month High Amid ETF Optimism and Corporate Treasury Shift

Litecoin surged to $128.40, its highest level in five months, fueled by speculation around ETF approvals and a $100 million corporate treasury pivot by MEI Pharma. The cryptocurrency has gained 41% this month, pushing its market capitalization to $9.4 billion.

Prediction markets reflect bullish sentiment, with Polymarket pricing an 80% chance of a Litecoin ETF approval in 2025. However, competition remains fierce—Myriad's traders favor XRP for the next ETF listing. Three major filings have emerged since mid-January, including applications from Grayscale and CoinShares.

Payment infrastructure data reveals growing merchant adoption, with CoinGate reporting increased Litecoin transaction volume. This aligns with the token's 12.3% weekly gain, currently trading at $123.60.

AI-Driven Investments Propel 88% Crypto Surge in July

Cryptocurrency markets witnessed an 88% monthly surge in July, fueled by artificial intelligence-driven capital inflows. The sector attracted $5.36 billion in startup investments, marking a significant rebound in institutional confidence.

Corporate treasuries are increasingly adopting crypto strategies, with MicroStrategy, Upexi, and MEI Pharma leading the charge. These firms have accumulated major digital assets including Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and Litecoin (LTC), blending AI sector focus with innovative asset allocation.

MEI Pharma's $100 million private equity raise for Litecoin adoption through the Litecoin Foundation partnership exemplifies this trend. Public companies now hold approximately $108 billion in Bitcoin collectively, signaling growing mainstream acceptance.

Toncoin and Litecoin Near Critical Resistance Levels —Analysts Eye Bullish Breakouts

Toncoin (TON) and Litecoin (LTC) are approaching pivotal resistance levels, drawing scrutiny from traders as altcoin season looms. Both assets combine technical potential with narrative momentum—a formula for breakout success in volatile markets.

The Open Network (TON), originally developed by Telegram, leverages its proof-of-stake architecture to enable fast, scalable transactions. Its rebranding from 'Telegram Open Network' to 'The Open Network' reflects broader ambitions beyond messaging apps. Meanwhile, Litecoin maintains its status as a Bitcoin proxy with faster settlement times, recently demonstrating resilience during market downturns.

Market structure suggests growing appetite for altcoins beyond Ethereum and Bitcoin. TON's innovative sharding mechanism and Litecoin's upcoming MWEB privacy upgrades provide fundamental catalysts. Neither project appears overextended on weekly charts—a rarity in the current cycle.

Litecoin Surges Over 11% in a Week, Analysts Eye $350 Breakout Target

Litecoin (LTC) has defied broader market stagnation with a 9.55% daily surge and 11% weekly gain, now trading at $121.30. Trading volume skyrocketed 167% to $1.46 billion, propelling its market cap to $9.23 billion—a clear signal of accelerating institutional interest.

Technical analysis reveals a critical triangle pattern forming since mid-2021, with LTC testing the upper boundary at $121. A confirmed breakout could trigger a parabolic rally toward the $320-$350 range, representing 185% upside potential. The convergence of rising volume and technical thresholds suggests this isn't mere speculation—it's capital positioning for the next leg up.

How High Will LTC Price Go?

Litecoin's price could rally 50% to $180 if it breaks the $130 resistance, with a long-term target of $350 based on:

| Factor | Impact |

|---|---|

| Institutional Adoption | MEI Pharma's $100M allocation |

| Technical Breakout | MACD/Bollinger Band bullish crossover |

| Market Sentiment | ETF speculation & payment growth |

BTCC Analyst Ava